deadline to pay mississippi state taxes

Taxpayers should pay their. To that end AB 1887 prohibits a state agency department board or commission from requiring any state employees officers or members to travel to a state that after June 26 2015 has enacted a law that 1 has the effect of voiding or repealing existing state or local protections against discrimination on the basis of sexual orientation gender identity or gender expression.

Late filing of W-2 or not filing at all.

. If you need even more time to complete your 2020 federal returns you can request an extension to Oct. Coming forward voluntarily and cooperating with the IRS to determine any taxes that are due and establishing a payment plan is a way to avoid criminal liability and get back into good standing with the IRS. 15 by filing Form 4868 through your tax professional tax software or using the Free File link on IRSgov.

You can Create a FREE account with TaxBandits and e-file W-2s before the deadline. The Senate has also passed legislation to use. As bickering between House and Senate leaders over tax cut proposals continues to worsen lawmakers face a critical deadline on March 1 to decide what to do with the teacher pay raise bills.

Filing Form 4868 gives taxpayers until Oct. What are the W-2 penalties for Mississippi. The capital expense fund is intended to pay for repairs and renovations to state-owned properties and specific projects authorized by the Legislature.

Even when individuals fail to pay their taxes the IRS generally prefers to resolve tax problems outside of the judicial system. Since the time for election of state officials varies VaCode 2136 2160 -- 2168. By 21 the poll tax must be paid at least six months prior to the election in which the voter seeks to vote.

At 222 the six months deadline. And educators watching closely this week worry that teacher pay could potentially get caught in the middle of the tax cut fight. Failure to furnish.

Whenever the state has excess revenues the money is split between the states rainy day fund and the capital expense fund which currently has about 11 billion. We support both Federal and State filing of W-2s. Maximum aggregate plan balance.

Paying the taxes late. Contributions and rollover contributions up to 10000 for a single return and up to 20000 for a joint return are deductible in computing Mississippi taxable income. Section 20 provides that a person must personally pay all state poll taxes for the three years preceding the year in which he applies for registration.

The state of Mississippi imposes W-2 penalties and interests for the following. 15 to file their 2021 tax return but does not grant an extension of time to pay taxes due.

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

How Long Americans Work To Pay Their Taxes Infographic Infographic Estate Tax Tax Time

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Coroner S Report Template Professional Order Birth Certificate Ms Pleasant Order Mississippi Birth Certificate Template Certificate Templates Birth Certificate

Mississippi State Tax H R Block

State Income Tax Extensions Weaver Assurance Tax Advisory Firm

List Of State Income Tax Deadlines For 2022 Cpa Practice Advisor

Mississippi State Tax Payment Plan Details

How Do State And Local Sales Taxes Work Tax Policy Center

Mississippians Encouraged To File 2021 Federal State Taxes Early

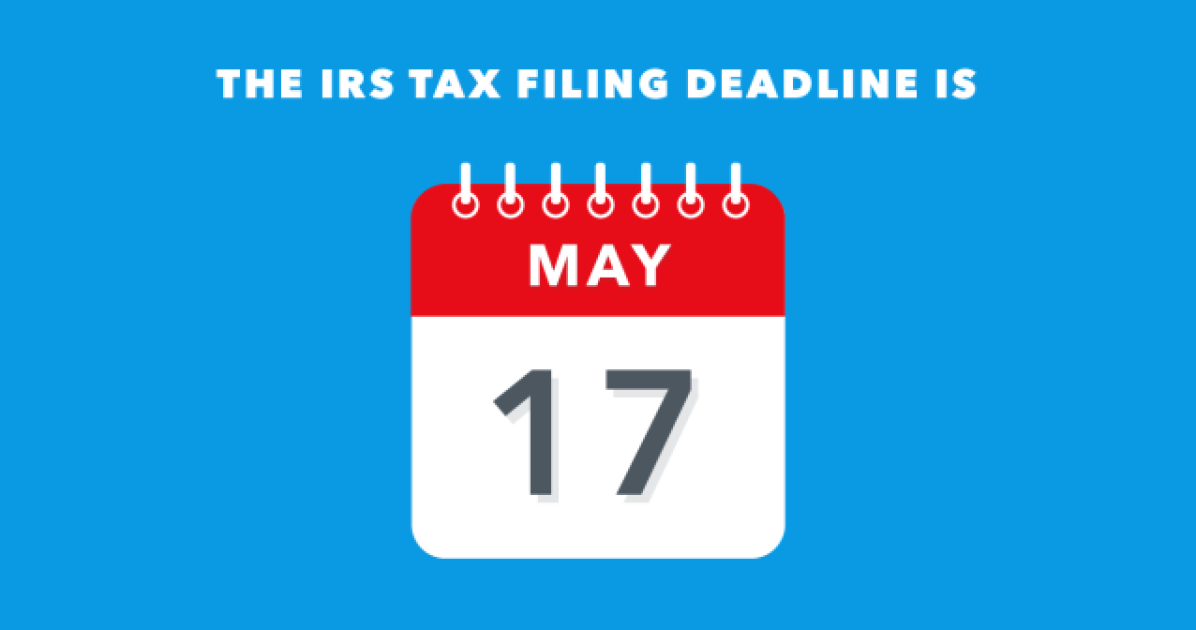

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Prepare Your 2021 2022 Mississippi State Taxes Online Now

Here S How To Track Your Stimulus Check From The Irs Irs Irs Taxes How To Find Out

2020 Tax Deadline Extension What You Need To Know Taxact

Tax Filing 2021 Which States Have Extended Their Deadline As Com

How Do State And Local Individual Income Taxes Work Tax Policy Center

Mississippi Sales Tax Small Business Guide Truic

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)